PRODUCT & SERVICES

Upcoming Services

Fire Insurance

Motor Insurance

Marine Insurance

Overseas Mediclaim Insurance

Engineering Insurance

Miscellaneous Insurance

Aviation Insurance

Latest Articles

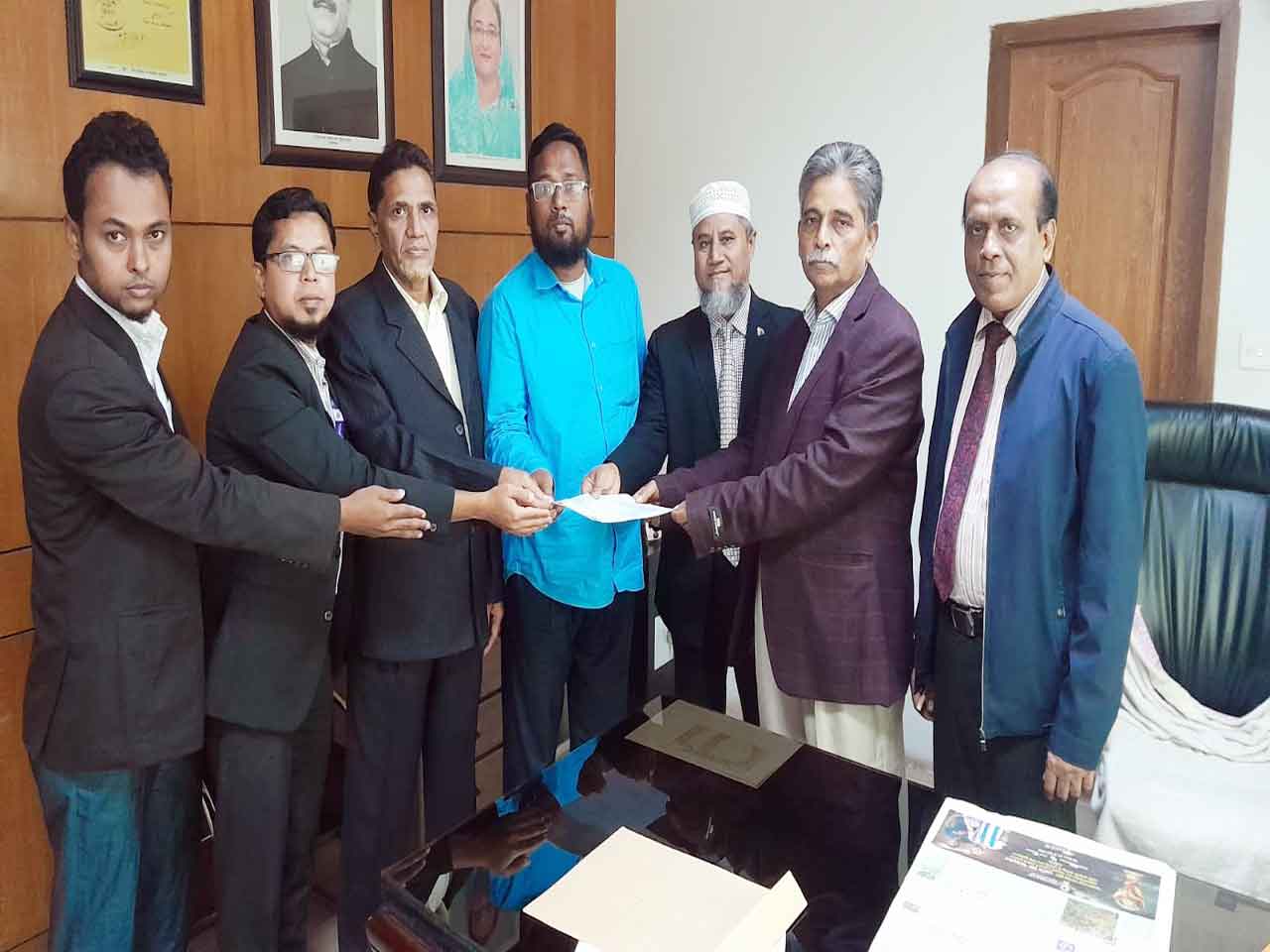

The latest articles from our blog, you can browse moreHomage at the memorial of the Founder Chairman of Sikder Group

On July 27, 2023, during the commemoration of the 10th anniversary of Sikder Insurance Company Limited, we honor the revered founder Chairman at the Sikder Group memorial.... Read More